what is a levy on personal property

Many state and local governments impose ad valorem property taxes on tangible personal property TPP in addition to property taxes applied to land and. Personal property is movable property.

Office Of The Tax Assessor City Of Hartford

It can garnish wages take money in your bank or other financial account seize and sell your vehicle.

. In many cases this property is a motor vehicle. An IRS levy permits the legal seizure of your property to satisfy a tax debt. Chattels refers to all type of property.

A lien is a legal claim against property to secure payment of the. This is different from a tax lien because a lien is only a claim to your assets while a levy is the actual seizure of the. A levy is the legal taking of your property to repay your unpaid taxes.

What Is a Property Tax Levy. Maximum Property Tax Regular Levy Rates. Property tax is the tax liability imposed on homeowners for owning real estate.

This can be a tax levy or some other form of judgment. The regular rates of levy may not exceed the following amounts. A personal property tax is a levy imposed on a persons property.

When a Levy on Personal Property is requested the Execution empowers deputy sheriffs to seize the personal property of the defendant. Its anything that can be subject to ownership except land. A levy is a legal seizure of your property to satisfy a tax debt.

Personal property can be broken down into two categories. The tax is levied by the jurisdiction where the property is located and it includes tangible property that is. Orange County Personal Property Levy Lawyer Personal Property Levies as a Judgment Collection Tool A personal property levy allows a creditor to obtain possession of much of the.

Up to 25 cash back If a creditor sues you and gets a judgment against you it can take specific items of your personal property to get paidThe judgment creditor must first obtain a. A lien is a legal claim against property to secure payment of the tax debt. A levy is when a creditor is allowed to take and sell your personal property.

At a Personal Property Sale a defendants personal moveable property which is subject to a levy is sold. Levies are different from liens. A levy is the legal seizure of taxpayers assets to satisfy back taxes owed.

Instruction for Levy-Original and two 2 copies It is the responsibility of the levying creditor to specifically describe personal property that is be levied upon Â3030 Florida Statutes and. For example if the assessed value of. A notice of levy is the way the IRS informs you that it will issue a levy if you do not take any action to pay your bill in the.

A levy is a. Levy Of Personal Property. A levy is simply a legal seizure of your property in order to satisfy your unpaid tax debt.

Rates are given in cents per 10000 Taxing Authority Class I Class II. A personal property tax is a tax levied by state or local governments on certain types of assets owned by their residents. If personal property such as household goods furniture office equipment and other such items are the subject of the levy the plaintiff is responsible for.

Its helpful to note that personal property includes both tangible and. Personal Property includes such items as furniture appliances. Often individuals use it regarding the.

Just about every municipality enforces property taxes on residents using. Personal Property Tax. A personal property tax is a tax levied by state or local governments on certain types of assets owned by their residents.

Under execution and levy property owned by the judgment debtor is taken and either delivered to the judgment creditor or sold with the proceeds of the sale delivered to the.

Irs Faqs What Does Irs Notice Of Intent To Levy Mean

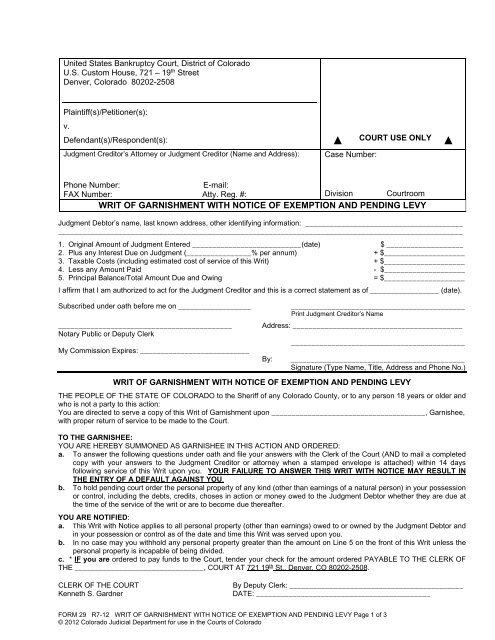

Writ Of Garnishment With Notice Of Exemption And Pending Levy

History Of Recent Personal Property Tax Legislation Proposal 1 Of 2014 Summary And Assessment Mackinac Center

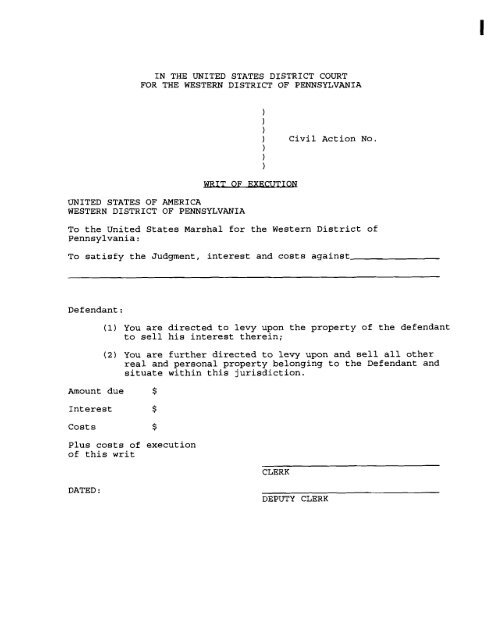

Writ Of Execution No Property Western District Of Pennsylvania

Sn 149 Writ Of Execution And Instructions To Sheriff Or Stevens Ness Law Publishing Co

Tangible Personal Property State Tangible Personal Property Taxes

Personal Property Levies The Wallin Firm

Tangible Personal Property State Tangible Personal Property Taxes

Understanding California S Property Taxes

Protect Your Property Ooraa Debt Relief

Tangible Personal Property State Tangible Personal Property Taxes

News Flash Sarpy County Ne Civicengage

How The 1 Property Tax Levy Limit Works San Juan County Wa

Cary Nc Levy Release Help Guardian Tax Solutions Inc

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-lien-and-encumbrance-Final-d9e63a6b2b3942be99b378b5bc49a237.jpg)

Lien Vs Encumbrance What S The Difference